Sometime in the last decade, software is eating the world became fintech is eating the world. The term “fintech” is a portmanteau of “finance” and “technology” and was coined in the 1990s but became popular after 2010. It’s a catchall term for companies that use technology to deliver better financial service experiences. In popular discourse, the term fintech often conjures images of new-age tech-first startups kicking old-school arthritic financial services businesses in their knees. But like all buzzwords, it’s largely a meaningless term.

Fintech is nothing new; if you think about it, everything, including the things we now take for granted, is fintech. The telegraph, invented in the 1840s, was the original fintech. It reduced the time to transmit stock quotes from New York to London from 16 days to 20 minutes. Actually, if you think about it, clay tablets were the original fintech. They were used in Mesopotamia and Sumeria to record loans as far back as 5000 years. The telex, mutual funds (unit trusts), credit cards, SWIFT, ATM, screen-based trading, ETFs, internet banking—everything is fintech.

The current wave of fintech companies started cropping up after the 2008 crisis with the popularity of smartphones, mobile apps, and increasing internet penetration. The profound distrust in the traditional financial system after the 2008 crisis was a tremendous tailwind and an underappreciated factor in the rise of fintech. The term didn’t really become buzzy well until 2013-14. It took hundreds of KPMG, BCG, PWC, and McKinsey reports with numbers and projections unsullied by reality for the term to catch on. Fintechs promised to revolutionize finance by delivering better financial services at lower costs with more transparency to the masses around the world and bring about financial inclusion in 8 days flat. In the process, they also promised to euthanize the traditional financial services out of an abundance of mercy.

Did they?

Absolutely yes! Fintechs have been nothing short of revolutionary.

- Fintech lending companies have built amazing apps for payday and predatory lending and are changing people’s lives. They charge 50%+ interest, but the apps have the best UI and UX.

- Fintechs are also solving the unemployment crisis in India. They will call you 13 times a day to offer you a credit card you don’t need, a personal loan you can’t repay, and offer to manage wealth you don’t have. It’s not spam; they just care too much.

- Everything is fintech now. You can buy life insurance on apartment management apps you typically use to search for plumbers when your toilet is clogged. You can also invest in mutual funds on dog walking apps. I don’t know about you, but I always make my personal finance decisions when searching for a dog walker.

- Fintechs have inspired an entire generation of thought leaders with #fintech on their Twitter and LinkedIn bios. It’s a delight to hear these people use blockchain and digital transformation every third word.

- Fintechs are also using artificial intelligence. They don’t know what it is, nor can they explain how, but they use it. How do I know? They told me.

- More importantly, fintechs are solving world hunger by integrating loans on food ordering apps.

Innovation! Revolution!

Jim Chanos and Matt Stoller put it best.

And then other mechanisms, we haven’t talked about fintech, but you know, sort of the shadow banking world of fintech, which, you know, I’ve been joking now for a while is just simply subprime lending.

JIM CHANOS

At the peak of the fintech buzz, obituaries were written for banks, insurance companies, financial advisors, and other traditional financial services businesses. But a decade after, fintech became a buzzword, it’s unclear what the fuss was all about. The promise that fintechs would replace traditional financial institutions turned out to be hollow propaganda. Instead, they either willingly partnered with traditional finance or were unwillingly co-opted.

These companies have a serious case of Attention-deficit/hyperactivity disorder (ADHD).

2015: Revolutionizing payments

2016: Revolutionizing mutual funds

2017: Revolutionizing insurance

2018: Revolutionizing loans

2019: Revolutionizing broking

2020: Oh, no. We’re going to die

2021: Revolutionizing everything all at once

2022: Revolutionizing predatory lending, sorry, fintech lending

Fintechs, as it turned out, were just glorified call centers with good-looking apps.

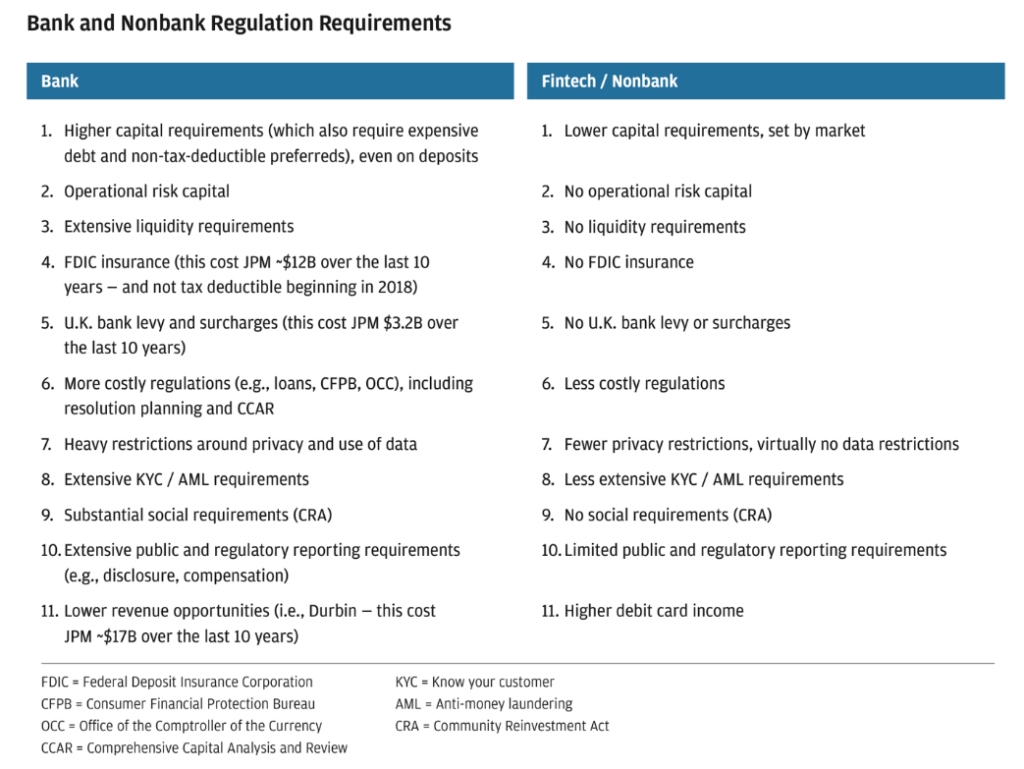

There’s a long-running joke that fintech is just regulatory arbitrage. It’s a tired trope, but it’s largely true.

Jamie Dimon had written about this in his 2020 letter:

We saw this just a few weeks ago when RBI issued a notification saying credit lines can’t be loaded onto prepaid payment instruments (PPIs). Fintech companies had found a sneaky way to simulate credit cards without issuing credit cards to offer Buy Now Pay Later (BNPL) loans. They had partnered with banks to issue prepaid cards and with NBFCs to issue credit lines which would be loaded onto the card, and voila, you have a credit…ish card. Several startups were doing serious business, and in one fell swoop, RBI killed the model.

There are countless other examples.

- Indian neo banks are just good-looking wrappers over existing banks and don’t make any money directly from the banks. But US Neo Banks do, and that’s because of an arbitrage in the interchange that commercial banks and small community banks can charge. Small community banks in the US can charge a higher interchange than large banks, thanks to a post-2008 crisis regulation. This allowed neo banks to make more than they otherwise would’ve if they had partnered with large banks.

- The entire shadow banking system of private lenders, NBFCs, asset managers, and digital lenders is a prime example of regulatory arbitrage. They can do most things banks do with far lesser capital requirements and fewer regulations.

- Indian platforms like Leadoff and Tyke that offer unlisted shares exist because the regulations on the sale of unlisted securities are unclear. If tomorrow, SEBI were to say, only brokers can facilitate unlisted securities on a separate platform to be operated by exchanges like a Request for Quote (RFQ) platform, these startups will vanish in a heartbeat.

- It’s the same with the so-called alternatives platforms that are offering securitized products that package loans, bill discounting, asset leases, etc. These platforms are not directly regulated by SEBI or RBI and are today able to sell investment products that are, in some cases, listed on the exchanges. They perform many functions of banks, advisors, and lenders. There’s also a more subtle difference. These platforms can get away with peddling absurd returns like 25-30% based on misleading claims. But if regulated brokers were to do that, they’d get a notice in a heartbeat—arbitrage.

- Indian brokers offering US investing by partnering with US-based brokers is another example of this arbitrage because regulations are unclear.

- SEBI recently stopped Indian brokers and advisors from selling unregulated products like digital gold.

- Another example is platforms like Strata that offer unregulated products like fractional real estate investing.

I could keep going, but the point is, that a vast majority of fintech business models are based on such arbitrages, and they are just one regulatory change away from knocking on heaven’s door. The removal of the Merchant Discount Rate (MDR) on UPI payments is a case in point. In some cases like the NBFCs, the regulators acknowledge this arbitrage and even tacitly give their blessing.

Of course, I’m not saying all of this is uniformly bad and I know this sounds polemical. Innovation often precedes regulation. I’m also not saying all these companies are useless. There are plenty of fintechs that are doing useful things. For example, all the payment apps have made paying for things infinitely better. Companies like Zerodha (I work here), Razorpay, Setu, Instamojo, Open, Acko, Zeta have actually built things that people and small businesses use. Of course, you could argue that most of these companies are built on UPI, Aaadhaar, Digilocker, etc., paid for by the Govt, but still, credit where it is due. At a broader level, most of fintech today is adding a nice UI over financial infrastructure that is held together by duct tape and hairpins. I call it duct tape as a service (DaaS) or better known as banking as a service (BaaS), embedded fintech, or product as a service )PaaS). Despite my skepticism, I’m incredibly bullish on fintech, especially wealthtech.

But history is also replete with examples of unregulated activities and regulatory arbitrages ending in disaster—2008 crisis, IL&FS crisis, US S&L crisis, and Wildcat banking. The most recent example is the spectacular implosion of crypto platforms like Celsius and Vauld that trapped millions of investors. These fintechs often make it seem like the line between innovation and fraud is very thin. Clearly, they must have some serious eyesight issues.

So if the business models are unsound and the regulators are destroying any perceived moats they had, how can they revolutionize the world?

Artificial intelligence, machine learning, and blockchain-powered predatory lending.

In the last few months, there has been a deluge of complaints about these lending and payments “fintech” platforms. They’re using every trick in the book from dark patterns to downright deception to drum up business. From adding BNPL credit balances to mobile wallet balances, payday lending to old school hiding things in the fine print. All these things make it seem like there’s no honest way for these companies to make money. A part of my soul used to die whenever I read the horrifying stories of US payday lending, but I wouldn’t have imagined seeing the same disgusting practices in India so soon.

A lawyer friend of mine told me a horror story recently. He had a lady client who had borrowed around Rs 1000-2000 on one of those instant loan apps, and she couldn’t repay on time. By the time she repaid, the collection agents had started sending obscene doctored videos about her to the contacts on her phone.

Check out all these shenanigans:

The other issue is the deteriorating macroeconomic environment. All these platforms were subsidized by venture capital money for a long time. Now that the easy money is drying up, VCs have suddenly discovered the meaning of words like revenues and profitability. With funding drying up, all these VC-funded fintechs will be forced to generate revenues and show profitability. I have a feeling it’s going to get infinitely worse.

Like most people, I used to watch Jon Stewart’s Daily Show in the early 2010s. Listening to Jon Stewart made it easy for me to pretend to be an expert on US politics without letting minor things like not having a clue about what I was talking about getting in the way. One of my favorite Jon Stewart moments was his appearance on CNN Crossfire, a silly political debate show hosted by Tucker Carlson and Paul Begala. He goes on the show and absolutely destroys the format and the hosts, leading to the show’s eventual cancellation. At one point on the show, he says:

I wanted to come here today and tell you guys—stop! Stop hurting America.

This line has been stuck in my head for a long time. That’s the exact thing I want to tell the founders of most of these Indian “fintech” companies.

Please stop hurting India!

Oh, and as I was writing this post, more fintech innovation!

Leave a Reply