Bill Burr is one of my favourite stand-up comedians and also someone you can easily relate to. At the 2014 all-star tribute to Don Rickles—another one of my favourite comedians—Jerry Seinfeld who was hosting, started the night by saying:

On the Mount Rushmore of stand up comedy there are four faces in my opinion: Richard Pryor George Carlin, Bill Cosby and Don Rickles.

Jerry Seinfeld

Comedy puritans would consider it heresy, but I’d say the same of Bull Burr. He’s a genius and has perfected the art of dancing around touchy topics and not getting cancelled…yet. Watching him make audiences squirm in their seats and pull back just when you think he’s about to step over the line is a real treat. I highly recommend checking out his specials, and his animated show F is for Family on Netflix.

He was on the Tim Ferris show earlier this year (no, I am not one of those “optimize your life by life hacking” nut jobs), and I had the episode on my podcast playlist for a while now. Too many podcasts, too little time 😭 Anyway, I recently finished listening to it, and I loved it—I highly recommend listening to it. I couldn’t get enough, and I started listening to other older episodes. There were a couple of things related to money that just stuck in my head.

Before I share them, I want to clarify one thing. There are some really special creatures on this planet. These creatures have all the same characteristics as humans. But despite the similarities, It is unclear if these creatures are actually human. But the said creatures have an amazing gift. They can take anything and connect it to investing. They could see a cow in the Indiranagar signal, and they can write an article titled “I saw a cow cross the Indiranagar signal, here are 5 investing lessons” in 10 minutes flat. This isn’t one of those posts.

Now, back to the topic at hand. There were two things from the conversation that stood out for me that kinda apply to investing and life. They stuck because of who Bill Burr is. He is an overnight success, three decades in the making. He has seen the lowest lows before he got to where he’s today. Whatever he says, at least to my mind, comes from a place of deep self-awareness. There’s absolutely no pretence whatsoever. I mean, I can count the number of such people on one hand.

This first bit was about being prepared for the inevitable curveballs in life from the episode this year.

Bill Burr: Because I’m self-employed. You can’t get too into this business. If you get too into this business, then you’re fucked. And then you become that guy.

Tim Ferriss: You mean just having contracts and relationships with people you

Bill Burr: No. You get in business with people, but that’s not your only thing. I’ll never stop doing standup and I have my podcast. And I don’t live a lifestyle beyond those. I live way behind those. So no matter whatever happens, whatever fucking slap on the wrist I’m ever going to get from the social media, I’m still going to be fine. It’s when you just go into this business and if you’re just an actor on a show or you just host something or whatever it is that all of a sudden, if you just did this, you didn’t have your podcast or any other way to make money, if all of a sudden there’s some bullshit rumblings, if the people above you go, “You have to go out there and apologize.”

You’re in a situation of like, or else I can become homeless. So then you have to go out there and even if you’re not sorry, you have to say you’re sorry. And I think that doesn’t look like a fun thing because I’ve seen people going out there squirming, trying to like, “How do I apologize without apologizing to the 40 drunk soccer moms who all tweeted at the exact same moment so this became a thing for eight seconds yesterday that I now have to address?”

This was from the older episode in 2017:

I got this weird thing about money where I want to have it so I’m not broke, but I don’t give a shit about it. But I also don’t want to have debt, so I don’t overextend myself, but I don’t give a shit about it. I will pay extra to not go through the process. I don’t use frequent flyer miles. My wife signed me up for them but I don’t use them ever because I don’t want to go through the fucking logging in and all of a sudden I’m working for American Airlines.

This also reminded me of two things Morgan Housel had written:

- Save like an optimist and invest like a pessimist

- 90% of individual investing is “spend less than you make, diversify, wait.” The other 10% is just trying to speed that up, for better or worse.

People spend thousands and lakhs on personal finance books and these utterly asinine personal finance seminars etc., but at a very high level, isn’t personal this simple?

If you strip away all the nonsense around personal finance, being prepared to survive is probably half of it. Despite being in finance, despite a lot of volatility in life, I had never realized this. It hit me hard during the pandemic when my family, like pretty much everyone else, had to deal with the nightmares.

Being prepared is also not just about money; that’s one part of it. But having adequate life insurance, health insurance, taking care of your health, developing other hobbies, being lucky enough to have a rich dad or a wife 😝—all these things can go a long way in making life a little more bearable. Most of us suck at most of these things, but we can always keep trying.

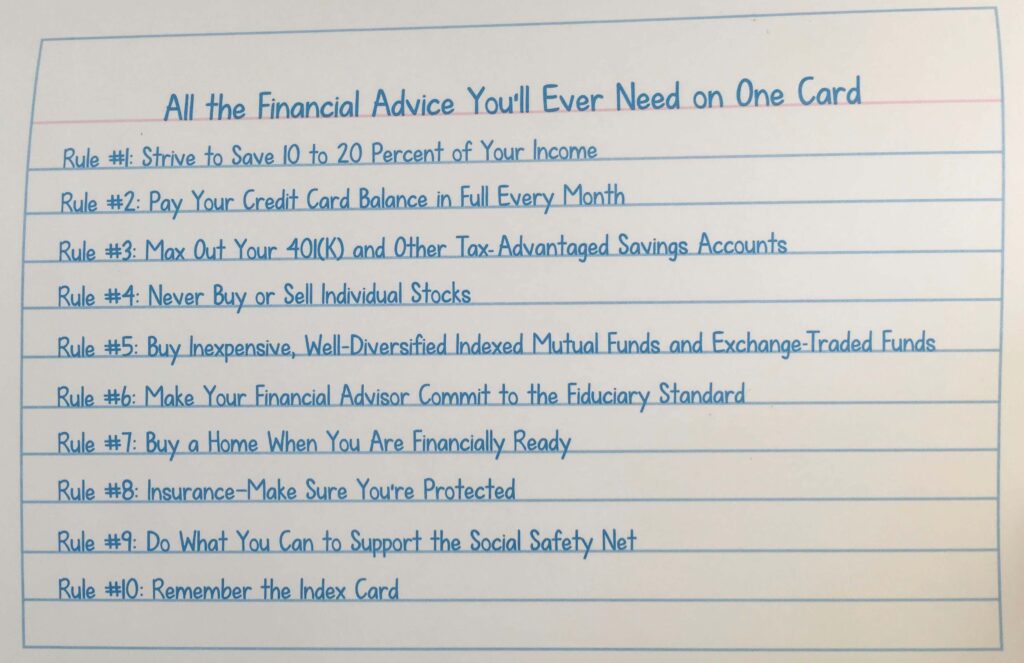

The other half is just ensuring the basics are covered. The financial services industry has perfected the art of peddling bullshit and scaring you into thinking that finance is complex and you need them to save you for a reasonable price of 2% of your AUM—most people don’t really need them. Everything that you need to take care of your personal finance can fit on a small index card. Of course, knowing something and implementing it are two different things. I learnt the hard way during the pandemic despite being financially literate!

The second bit was about optimism vs pessimism.

Tim Ferriss: If you could have any billboard you wanted, non advertisement, but just a message you want to get out to the world, what would you put on it?

Bill Burr: The first thing I’d probably do is “Go fuck yourself.”

Tim Ferriss: Go fuck yourself.

Bill Burr: No. I’m kidding. I’m kidding. I’m kidding. Maybe I would — I just would have “No, it isn’t.”

Tim Ferriss: No, it isn’t.

Bill Burr: No, it isn’t.

Tim Ferriss: I like it.

Bill Burr: No. So much people don’t know what the fuck they’re talking about. And they’re just so… so much time getting you into this fucking panic. And then “This is going to happen, and that, and [big dummy noises].” Just breathe. No, it isn’t. You’re going to be fine.

Tim Ferriss: All right. So —

Bill Burr: Even if you’re not going to be fine, isn’t it better to just exist thinking you’re going to be fine until it’s not fine? And then when it’s not fine, then you can just fucking handle it then. But there’s no sense to ruin right now. Right?

This is all the more important given whatever is happening in the world with climate change, floods, famines, wars, inflation, and crashing markets, among other things. At the risk of sounding flippant and Pinkerian, the world is always ending, yet here we are. I hope I didn’t just piss off some eco-terrorist. This isn’t to minimize the existential threats we face. Our chances of dying are perhaps the greatest at any point in history—we’ve done well!

History is “just one damn thing after another” said Arnold Toynbee. Dan Carlin’s book The End is Always Near highlights periods – from pandemics to nuclear war – where it felt like the world was coming to an end. They exist in every era, every continent, every culture. Bad news is the norm.

Morgan Housel

But is giving in to pessimism the answer? No. You need a healthy balance between pessimism and optimism to get through life.

Being overly optimistic can be equally dangerous as being overly pessimistic. Too much optimism can lead to complacency, and too much pessimism can lead to resignation. Don’t take it from me, I’m just another moron on the internet.

This is a topic that some of the smartest people that ever lived have grappled with for centuries. Maria Popova is one of the finest curators of the internet. Her site, The Marginalian, is a treasure trove of perspectives on life and meaning from some of the greatest minds that ever lived. In searching the site, here are some moving thoughts on the topic that I came across.

Rebecca Solnit on hope and cynicism:

It’s important to say what hope is not: it is not the belief that everything was, is, or will be fine. The evidence is all around us of tremendous suffering and tremendous destruction. The hope I’m interested in is about broad perspectives with specific possibilities, ones that invite or demand that we act. It’s also not a sunny everything-is-getting-better narrative, though it may be a counter to the everything-is-getting-worse narrative. You could call it an account of complexities and uncertainties, with openings.

Rebecca Solnit

Erich Fromm on faith:

Optimism is an alienated form of faith, pessimism an alienated form of despair. If one truly responds to man and his future, i.e., concernedly and “responsibly,” one can respond only by faith or by despair. Rational faith as well as rational despair are based on the most thorough, critical knowledge of all the factors that are relevant for the survival of man. The basis of rational faith in man is the presence of a real possibility for his salvation: the basis for rational despair would be the knowledge that no such possibility can be seen.

Maria Popova herself summarized it best in another post:

Critical thinking without hope is cynicism. Hope without critical thinking is naïveté.

Albert Camus on tragedy and despair:

Let us know our aims then, holding fast to the mind, even if force puts on a thoughtful or a comfortable face in order to seduce us. The first thing is not to despair. Let us not listen too much to those who proclaim that the world is at an end. Civilizations do not die so easily, and even if our world were to collapse, it would not have been the first. It is indeed true that we live in tragic times. But too many people confuse tragedy with despair. “Tragedy,” [D.H.] Lawrence said, “ought to be a great kick at misery.” This is a healthy and immediately applicable thought. There are many things today deserving such a kick.

And then there’s this from Morgan Housel:

Hearing that the world is going to hell is more interesting than forecasting that things will gradually get better over time, even if the latter is accurate for most people most of the time. Pessimism can be hard to distinguish from critical thinking and is often taken more seriously than optimism, which can be hard to distinguish from salesmanship and aloofness.

Morgan Housel

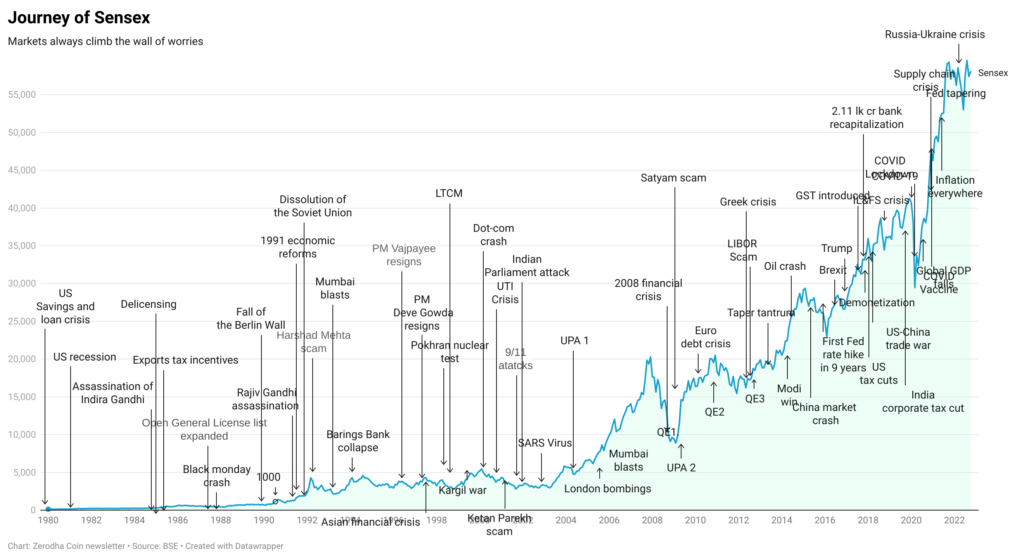

Talking more specifically about the markets, it’s always easy to rationalize a million different reasons the markets will crash You would have heard of the pithy statement hope is not a strategy a million times. The statement is largely true, but there’s some truth to it. In investing, there are a million things you can’t control. But there are a few that you can like being diversified, keeping your costs low, building a portfolio that suits your temperament, and sticking to a strategy that allows you to sleep at night, all the while being mindful that you’re one mistake away from permanent ruin.

But once you’ve taken care of these things, isn’t investing an irrational belief the Indian economy and Indian companies will do well? How else can the markets go up in the long run? Of course, being an optimist doesn’t mean you buy garbage stocks and funds and hope they do well.

Since the 2008 financial crisis, the permabears have faced tremendous hardships. They were 120% sure the markets would crash—they didn’t. Since they knew for sure that the markets would crash, they thought gold would go to the moon—instead, it was stuck in Silk Board. Some permabears sat on cash, thinking they could go shopping after Armageddon-cash was more useless than trash.

But since the beginning of the year, the atrophied larynges of these people have had a new lease of life. It only took 14 years, but all their predictions seem to be coming true. Given the inflation, rate hikes and volatility in the markets, the macro guys have become insufferable. They are back to making apocalyptic predictions with a reckless abandon that would even make the most deluded astrologers blush. A casual glance at finance Twitter, Zerohedge and CNBC is enough to make you think that we’re 8 hours away from the markets going to zero.

In Feb 2022, when the first leg of the down move was underway, I made this chart for this post.

There’s always been a non-trivial probability that the world isn’t ending in a hurry and that the Indian and US markets will climb the wall of worries. But this year, a lot of investors are acting as if Nifty is going to 50. All things considered, In the long run, betting that the Indian economy will do well and that earnings of corporate India will grow at a decent pace has been rewarded well. Will it always be? I don’t know. But isn’t that what we’re all betting on? If that’s not hope, I don’t know what is. On the other hand, betting that we’re headed for ruin has been the guaranteed way to end up in the poorhouse.

But even otherwise, I agree with Bill Burr on this:

Even if you’re not going to be fine, isn’t it better to just exist thinking you’re going to be fine until it’s not fine?

Bill Burr

This line reminded me of the ending of Don’t Look Up.

I don’t know about you, but I’d rather have a steaming hot cup of strong sugarless filter coffee if I was 100% sure that apocalypse is indeed just 2 Marathalli signals away.

Links

A recent profile on him.

Bill Burr on the Time Ferris show in 2022.

Bill Burr on the Time Ferris show in 2017.

“The Internet is an Abusive Relationship” Amen! He was on the Triggernometry podcast recently.

Leave a Reply