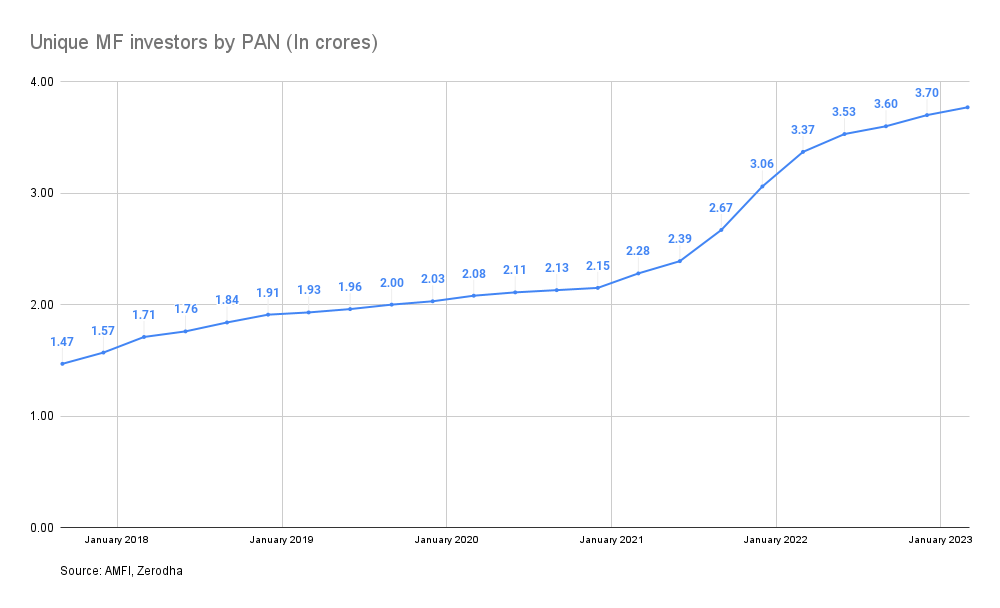

If you are working in financial services, you would have heard or thought about this: “India has 140 crore people, and even if 10–20% of the population starts investing…” If you look at the data, you’ll quickly realize that your assumptions are from Mars and the reality is from Venus. There are just 3.37 crore unique mutual fund investors. If you add the unique demat account holders, the number goes up to 5-6 crore. That’s it. That’s the total population investing in the stock market. I’m excluding the indirect participation through EPFO, of course.

Most people on the outside looking in at the Indian financial markets think that the real problem to be solved is better platforms, fancy features, and better stock or mutual fund recommendations. Sure, “AI-powered stonk tips powered by machine learning on zero trust blockchains” help, but that’s not the real problem.

So, what does it take to expand the markets?

As that old saying goes, “It takes a village to raise a child.”

It takes the concerted action of financial intermediaries, regulators, the government, and individuals to expand the markets.

Speaking about individuals, one interesting development in the last five or so years in the Indian markets has been the rise of financial influencers. These are individuals with large followings on platforms like YouTube, Instagram, Twitter, etc. Influencers exploded in popularity after the COVID-19 pandemic, when the stock market became a global pastime and millions of new investors entered the markets. Credit where credit is due, through their videos, reels, and paid courses, these finfluencers have attracted lakhs of new investors (I know you’re thinking gamblers) into the markets.

I know that’s a blasphemous thing to say, and before you bite my head off, hold on! An influencer is anyone who can influence the actions of others. It goes without saying that there are good influencers and other influencers who should be given free tickets to the first Elon Musk rocket to Mars.

So, what’s the issue?

The success of some of these influencers has attracted hundreds and thousands of other wannabe influencers. If you throw a rock anywhere in India, you’ll hit an influencer. I’ve followed most of these finfluencers since they were unknown. You and I can quibble about it, but in the initial days, most of them used to say generic and harmless things. Then the pandemic hit, and things went south. For every sensible influencer, there were ten new loudmouths. Times were good in the markets, given the massive influx of new users wanting to prove that they were better than that old guy, Warren Buffett. The influencers were making money hand over fist from sponsorships and courses.

Then inflation rose, interest rates spiked, the stock market took a tumble, VC funding dried up, and sponsorships vanished. These influencers were still making money, but not as much as earlier. So now, stock market and personal finance courses have become the new golden geese. But courses still don’t solve the problem. Since 2022, the pace of new user growth in the markets has dramatically slowed.

So how do you attract new users to your course?

Escalate!

In the last couple of years, these fininfluencers went from saying harmless things to spreading dangerous nonsense. Look, I have no problem with people making a living, but there are some ethical and moral lines.

I wrote about these influencers in July 2022, when several of them recommended crypto platforms that went bust. Since then, things have gotten worse. All it took was Nifty falling by 15% for these people to go from suggesting index funds to selling endowment policies to ruining teaching kids about investing. The nonsensical things these people are saying to attract new people to their courses and generate views on their videos are funny but alarming.

A few gems that recently fell from the mouths of these geniuses:

- The stock market is a Ponzi scheme, and the only way to retire successfully is to participate in the Ponzi scheme.

- If you don’t time your SIPs and keep getting in and getting out, you will lose money.

- My personal favorite: Instead of repaying your credit card immediately, you can invest that money for 45 days, mint free money, and repay on the due date and not before.

- Are you renting a house? If you had invested your rent money in Nifty and slept on your neighbor’s balcony, assuming even a 10% rate of return for 25 years, you would’ve made crores. One can’t help but do the same calculation with spending money on soaps, agarbattis, and undergarments.

- Another genius calculated the ROI on the Taj Mahal and suggested that the gormint stop constructing useless buildings.

- Another genius one-upped this by doing the same calculation for a famous statue.

- Another genius escalated this further by calculating the ROI of the Parliament building. He’s right; Parliament vs. Oyo Rooms? It’s not even a competition.

- My other favorite is probably a demonstration of the greatest increase in human IQ ever. An influencer went from making funny videos to offering divorce advice. And stupid people say you have to study law to offer legal advice. Idiots.

These financial influencers have become a real nuisance. It’s a wonderful model. Today, if you are a research analyst (RA) or an investment advisor (RIA), you must abide by a litany of rules before opening your mouth. Hell, RIAs have to pay to get their advertisements approved and cannot publish them before that. If you don’t want to do all that, start a YouTube channel and say whatever you want.

In a sign of the times, these influencers were featured on the front page of Economic Times and other regional dailies with government logos, no less.

A cursory look is enough to realize that what many influencers are doing is the exact same thing as registered RAs and RIAs. In the guise of “educational videos,” “mentorships,” “and seminars,” these people are offering advice and even committing downright fraud. Again, I am not painting everyone with the same brush. Good influencers are the exception, not the rule.

You can try to educate people, warn them, and put in deterrents, but greed is one helluva drug. The person saying, “Invest in mutual funds for the long term and focus on your goals,” will always look like an idiot compared to a loudmouth selling a course where you can learn how to time Nifty to make double the returns with half the volatility. Despite all the information and awareness, people keep getting misled by these pied pipers and losing their hard-earned money.

I started the post by saying that the real problem to solve in the markets is not “AI-powered quantum computing stonk tips,” but finding ways to expand the markets. In theory, influencers are a part of the solution, but in reality, they’ve become the problem. I’m shocked that they don’t have the common sense to realize that they have to be responsible, considering their large following. In an ideal world, investors should learn, do their due diligence, and then invest their hard-earned money or find an advisor. But we don’t live in an ideal world. When these influencers know that people are investing their hard-earned money based on whatever they say, I don’t understand how they can continue to be stupid and escalate their stupidity with each passing day.

Being an influencer is just like running a business. Why will anyone interact with a business if it’s untrustworthy? Just like trading and investing, making money is hard. Sometimes, you might get lucky, but the odds are that you will lose it all. It’s the same with being an influencer. If you continue saying ridiculous and dangerous things, in the short run, you’ll get views, likes, followers, more sponsorships, and make a lot of money, but no one will trust you in the long run.

Be a part of the solution; don’t add to the problem.

Be a part of the solution; don’t add to the problem.

Leave a Reply