A few things that made me go, ooh, that’s interesting.

What’s old is new again

The Lindy Effect is this notion that the longer something survives, the less likely it is to die. When it comes to frauds, pump and dump schemes are Lindy. Pump and dump schemes have been going strong for over 400+ years since the birth of the modern stock exchange.

It’s a weird coincidence, but in the last month, several pump and dump schemes have come to light and surprisingly caught the attention of journos. It started in March when several popular people started tweeting that they were being offered money to promote a stock called Salasar Techno.

The Ken wrote about this:

He adds that such schemes often target stocks with a share count of less than 50 million, where promoters account for the majority of shares. Such stocks typically see more volatile, low-volume trading and are easier to manipulate through coordinated efforts. Marketing agencies are contacted, and usually given a mandate to promote the company online. It’s unclear whether these agencies are contacted directly by companies or by brokers, operators, and promoters.

At the end of March, SEBI pulled Ruchi Soya when it discovered SMS tips promoting FPO and the discount. Then I saw this tweet last week about a pump and dump in a new stock called Supreme Engineering.

Is it just a case of enterprising entrepreneurs responding to a market opportunity?

As I mentioned, pump and dumps through stock tips are as old as the financial markets themselves. Investor Amnesia by Young Jamie Catherwood is probably the best blog about financial history on the internet. The site is like a time machine for financial markets. Here’s an excerpt from a post about a pump and dump as far back as the 16th and 17th century in the Dutch stock exchange, the world’s oldest stock exchange:

One can readily imagine a 17th century pundit forecasting how political developments in Europe will effect the Indian economy, and ‘What it Means for Your Portfolio’.

On the Dutch stock exchange during this period, a small group of speculators realized how easily influenced their peers were by individual trader’s decisions, and the short-term news cycle. Manipulating the market, therefore, was as simple as providing traders with the ‘hot tip’ that they scoured the exchange for each day.

An effective system was quickly developed in which the savvy speculators accidentally dropped notes around the exchange that held misleading stock tips:

“If it is of importance to spread a piece of news which has been invented by the speculators themselves, they have a letter written and [arrange to have] the letter dropped as if by chance at the right spot. The finder believes himself to possess a treasure, whereas he has really received a letter of Uriah which will lead him into ruin.” — Joseph de la Vega (1688)

Lindy!

From “accidentally dropped notes”, gossip, neighbours, shoe shiners, SMS to influencers on YouTube, pump and dump schemes have evolved with the times. YouTube, in particular, has become a cesspool of pump and dump schemes.

The Ken published a piece on Indore, the stock tips capital of India.

“If lured once, customers end up spending between Rs 3,00,000 ($4,000) and Rs 4,00,000 ($5,200), typically,” the executive adds, noting that advisors earn their service charges irrespective of whether the investment gains or loses. Other approaches can be as blatant as telling half the potential customers to buy something and telling the other half to sell. The subset of customers that benefit from the binary advice can then turn into consumers for more services.

Today, Livemint had a feature on pump and dump scams on Telegram channels. Legend 👇

Yet another channel is run by an individual in Bihar whose experience, before 2017, was solely marketing for retail chains. Before he began giving “super HNI calls” (tips that high networth individuals use), he was the CEO of a departmental store. Currently, his firm is dolling out stock calls to 31,000 subscribers for free. He also has a premium model—for ₹10,000, he would advise “buying the next multi bagger stock”.

Of course, none of this is anything new. 2018 was a particularly busy year for stock tipsters, and there was a deluge. I had written a small post tracking the performance of some of these pump and dump episodes. My boss wrote about pump and dumps and other stock market scams a couple of years ago.

But with the popularity of Twitter, Telegram, Discord, and YouTube influencers, there are more places and more ways to run the scams than ever. It’s scary how easy it is to run a pump and dump without getting caught. Using influencers to pump and dump stocks and crypto is proving to be by far the most effective outlet. It’s a neat way for the scammers to leverage whatever trust these influencers have among their followers.

My gut says we’ll see a dramatic increase in pump and dumps as our markets grow. Not just with stocks, but more and more things, including our very lives, become more financialized, the number of things that can be manipulated will go up. Up until a few years, it was just stocks, now we have crypto, and soon in a dystopian world, it’ll be humans 😬

I don’t really see how these things can be controlled, let alone stopped. It’s like playing a game of whack-a-mole in 20 different places at once.

Crypto

Worldcoin

Crypto is like a party at 11 PM; there’s always peak craziness. Like most people, I don’t get most things about crypto. But I get that dismissing it entirely out of hand is foolish. So, I’d say I’m an interested skeptical observer. Crypto is fun because just when you think something is nuts, there’s immediately something even nuttier.

How would you like to get $20-$25 and some crypto tokens for free?

This is what Worldcoin co-founded by Sam Altman, the CEO of OpenAI and the former president of Y Combinator, is promising. Wordcoin wants to bring crypto to the masses by giving free crypto tokens to every single living human being on the planet. All you have to do is get your eyes scanned by a chrome orb that looks like a murder weapon from a Kannada movie and share your biometric data? Why? From what I understand, Worldcoin wants to “promote crypto” and become the Aadhaar and UPI of WEB3.

This all sounds like something George Orwell would’ve been proud of. Who knows, if he was alive, he might have even become a YouTube influencer for Worldcoin. But shockingly, things aren’t going well. Buzzfeed and MIT Tech Review published a damning expose of the project. Contractors hired by Worldcoin are systematically targeting poor communities across Africa and Asia to collect their biometric data in dubious ways. The bigger issue is that nobody knows what the project is about, what will the data be used for, or how will the data be stored. The project has all the hallmarks of a success story.

Pete Howson, a senior lecturer at Northumbria University who researches cryptocurrency in international development, categorizes Worldcoin’s actions as a sort of crypto-colonialism, where “blockchain and cryptocurrency experiments are being imposed on vulnerable communities essentially because…these people can’t push back,” he told MIT Technology Review in an email.

Speaking to Blania clarified something we had struggled to make sense of: how a company could speak so passionately about its privacy-protecting protocols while clearly violating the privacy of so many. Our interview helped us see that, for Worldcoin, these legions of test users were not, for the most part, its intended end users. Rather, their eyes, bodies, and very patterns of life were simply grist for Worldcoin’s neural networks. The lower-level orb operators, meanwhile, were paid pennies to feed the algorithm, often grappling privately with their own moral qualms. The massive effort to teach Worldcoin’s AI to recognize who or what was human was, ironically, dehumanizing to those involved.

Here’s Richard Nieva, who wrote the Buzzfeed piece, talking about his experience:

Death by TDS

The new Indian income tax regime for crypto went live this month. Income from crypto will now be taxed at 30%, and a 1% TDS will be applicable on each transaction. As if that wasn’t bad enough, crypto platforms are having a tough time finding payments partners willing to work with them. All the major crypto apps have disabled UPI payments; Coinswitch Kuber seems to have completely disabled all fund transfers. Mobikwik, which was a popular payment option to transfer funds to crypto wallets, also stopped supporting crypto payments. All this happened after Coinbase proudly announced its Indian launch and said it supported UPI payments, and NPCI said it had no idea about it.

This month has been a case of when it rains, it pours for Indian crypto.

If this data is to believed, and I’d take it with a few spoons of salt, crypto volumes are apparently falling off the cliff:

Crypto trading has been dealt a double whammy by tax implementation and MobiKwik withdrawing its services across exchanges on April 1 amid unclear regulations. Volumes have fallen further from the last week by over 50 percent on average across crypto exchanges, according to data shared by crypto research firm CREBACO. WazirX saw a drop of 72 percent while volumes on CoinDCX and Zebpay dropped over 52 and 59 percent respectively.

The only people who must be still buying are probably the true crypto believers or people who don’t understand taxes. I wonder how the Indian crypto industry is going to survive this. It makes zero sense to trade crypto anymore. You could argue that buy and hold guys might continue investing. Sure, but all the anecdotal data points in public and private toward Indian crypto ticket sizes being tiny, a few thousand at best. These crypto platforms can’t survive on investors alone, they need active traders.

Death by a thousand laws

Crypto is too large and too noisy to ignore. It’s also downright impossible to effectively impose total bans. So, that leaves the regulators with just one viable open—death by a thousand laws. This is what we’re seeing across much of the world. But that doesn’t mean that the crypto industry is sitting idly by. There seems to be a concerted lobbying effort to tilt the odds in their favour before federal laws are passed in the US.

Crypto lobbyists have managed to get several states to pass bills that they’ve crafted:

The debate took less than four minutes. In the Florida House last month, legislators swiftly gave final approval to a bill that makes it easier to buy and sell cryptocurrency. The Senate followed, sending the bill to Gov. Ron DeSantis for his signature after 75 seconds of deliberations.

At least 153 pieces of cryptocurrency-related legislation were pending this year in 40 states and Puerto Rico, according to an analysis by the National Conference of State Legislatures. While it was unclear how many were influenced by the crypto industry, some bills have used industry-proposed language almost word for word. One bill pending in Illinois lifted entire sentences from a draft provided by a lobbyist.

Things are much slower at the Federal level. The only major development so far has been the executive order by Joe Biden in March asking various regulatory bodies and agencies to explore consumer protection, financial stability, illicit transactions and innovation-related aspects of crypto. Kevin Werbach had a brilliant post dissecting the order.

SEC chair Gary Gensler’s remarks at the recent Penn Law Capital Markets Association Annual Conference, had some interesting hints. He reiterated that many of these tokens are “securities”, meaning they fall under the SEC’s regulatory purview. He also mentioned that the SEC is working on figuring out if crypto platforms should be registered and regulated as exchanges.

There’s no reason to treat the crypto market differently just because different technology is used. We should be technology-neutral.

We already have robust ways to protect investors trading on platforms. And we have robust ways to protect investors when entrepreneurs want to raise money from the public.

We ought to apply these same protections in the crypto markets. Let’s not risk undermining 90 years of securities laws and create some regulatory arbitrage or loopholes.

In Europe, the European Parliament passed new rules as part of anti-money laundering regulations that make anonymous crypto transactions impossible. Exchanges will now have to collect information about buyers and sellers so that they can be traced anytime.

Young HODLers

When I was 5-years old, I was still figuring out the world. I’m not embarrassed to say that this involved licking a few doorknobs. A few tree trunks, too, might have been involved—learning by trial and error. But times have changed. Now, kids as young as five are learning how to HODL at crypto camps for kids:

The weeklong camp, which costs $500, divides kids into four age groups and has them spend a set amount of time on different tech modules that follow the acronym Beastmode (that’s blockchain, evolution of money, artificial intelligence, security/cyber, technology/virtual reality, mining and machine learning, online gaming, drones, and engineering)

The other shocking yet funny bit:

Teachers say they are noticing their students spending more time on platforms like Robinhood, where people can buy and trade crypto. He’s heard one story from a fellow teacher about a ninth grader at another school who made a bet on a college football game and won $500,000, then had to pretend that his father had actually made the bet.

Worst case scenario, the kids learn how to rug-pull, but at least they won’t be unemployed.

This is going to get a lot messier, I guess 😥

Buy now, pay never?

I knew buy now, pay later (BNPL) was popular, but I didn’t know that it was 15-25% of all e-commerce payments in several countries like Norway, Germany, and Sweden. Surprisingly, in India, 37% of all loans disbursed through digital channels by commercial banks and 12% by NBFCs were BNPL loans.

BNPL players have largely grown thanks in part to the regulatory arbitrage. Since they aren’t regulated today, they can play fast and loose with disclosures, consumer protection, data collection, and credit reporting. The regulators are aware of the risks here. Everybody from the RBI, ASIC, CFPB to FCA have made noises about regulating BNPL.

Of course, like anything new, there will always be good and bad. But sometimes, the bad things can quickly get out of hand if not curtailed. BNPL is largely unregulated, leading to concerns about BNPL inducing people to borrow more and playing fast and loose with regulations.

One of the biggest problems for e-commerce and other platforms is cart abandonment. Most people abandon their purchases simply because they can’t afford the purchase, opaque terms and conditions or payments friction. Enter BNPL. By allowing users to pay for their purchases in instalments, often at 0% interest, BNPL has been shown to reduce cart abandonment rates. The really good UI/UX helps too. In just about 3-4 years, BNPL has quickly become a prominent payment option on shopping platforms worldwide.

Like with everything, the power of defaults can be harnessed both for good and bad. The most famous examples of using defaults for good are opting-in people to save for retirement in 401K plans and donate organs by default. In the US, people weren’t saving for retirement. So Richard Thaler and Shlomo Benartzi changed the choice to opt-in people to save by default instead of employees having to opt-in. Thanks to this default, millions of people are saving for their retirement.

The same defaults can be used for bad too. Most 401K plans tend to have target date funds as a default investment option. So if an employee doesn’t choose how he wants to invest, target date funds will be used as the default. Target date funds might not be perfect, but they are better than nothing and get the job done for most people. Studies show that a vast majority of people stick to default choices. A lot of 401K retirement plans have used leveraged this tendency to peddle costly and useless investments.

Similarly, by using BNPL as a default, a lot of people might be subtly pushed to take debt they otherwise might not need to. Given that BNPL is unregulated, a lot of these BNPL players have really opaque terms and hidden charges, which compounds the problem. We’ve seen several examples in India. Ola Postpaid users were shocked to find that they had taken loans without knowing.

Same with Mobikwik BNPL. What you see is a nice UI for BNPL, but what is really happening is that a bank is giving a loan on behalf of Mobikwik.

There’s also a behavioral explanation here. Studies have shown that people tend to spend more when they use digital payments than physical cash. Reducing friction everywhere isn’t a universal good. In some places, a little friction is a good thing:

The cashless effect describes our tendency to be more willing to pay when there is no physical money involved in a transaction. It means that we are more likely to purchase something on a credit card than if we have to pay for it with cash.

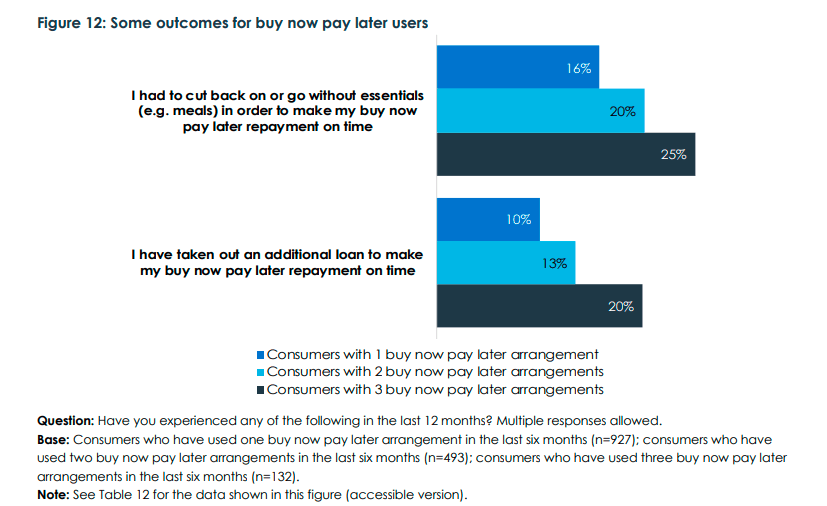

Though BNPL is new, some preliminary data from large markets like Australia and the UK show that some people are becoming more indebted. Data from the Australian Securities & Investments Commission (ASIC) shows that people are cutting back on essentials to pay their BNPL dues. Some people are also taking more debt to pay back BNPL dues. Perhaps, the scariest thing is that over 50% of these users are in the age group of 18-29. Catch em young?

A working paper looking at BNPL in the UK had similar findings. A lot of people are repaying BNPL with their credit cards. The sentence “some consumers may be entering a debt spiral” gave me the heebie-jeebies:

We find UK credit cardholders charge a BNPL transaction to their credit card: 19.5% of active credit cards in December 2021 have at least one transaction by a BNPL firm on their credit card during 2021. Charging BNPL debt to credit cards is a warning flag for consumer financial protection regulators as it raises doubts on some consumers’ ability to pay for BNPL. Some consumers may be entering a debt spiral transforming a 0% interest BNPL debt that amortizes over a few instalments transforming into credit card debt that typically incurs 20% credit card interest rates and has decades-long amortization schedules if they only pay the credit card minimum payment.

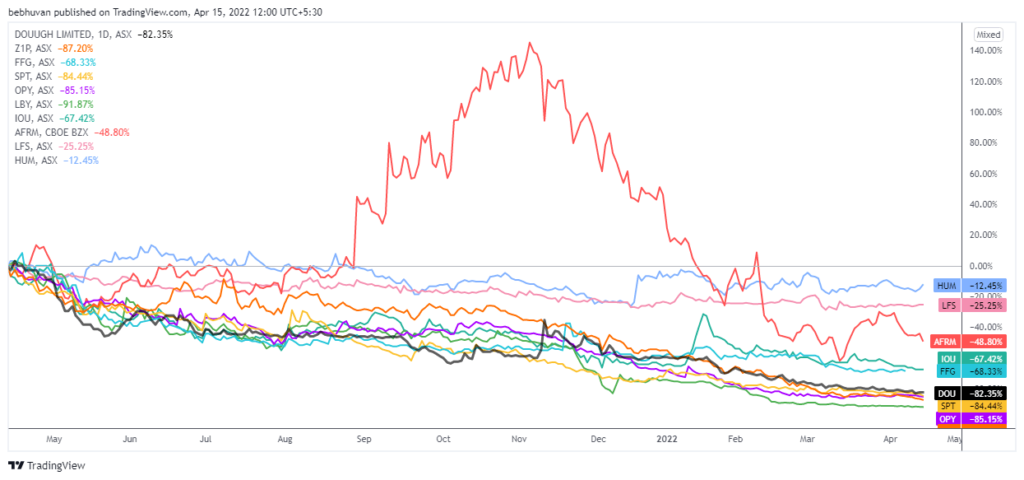

But it looks like there’s trouble in paradise. Most Australian BNPL stocks have fallen as much as 80-90%. This can be largely explained by rising interest rates and the cloudy regulatory environment.

I have a feeling we’ll see a wave of shutdowns, fire sales, mergers and acquisitions. Regulatory arbitrage isn’t a moat.

Buy now, burn now!

Things worth reading

Pieces on how social media is running the world are nothing new. But Jonathan Haidt’s latest post presents a sweeping view of how social media makes us and our institutions unbearably stupid. There’s nothing new that we don’t know of in the piece. But what makes this post brilliant is the fact that it connects so many dots at once. Most pieces about the impact of social media quickly become polemical to the point of losing whatever semblance of objectivity they start with. But in this piece, Jonathan Haidt effortlessly swings between the left and the right and tears both the camps to shreds and backs up his assertions with research. The picture he paints by the end of the piece of just how profoundly polarized and stupid people have become doesn’t inspire confidence that humanity is going to make it. Yet, unlike other pieces that stop at “we’re going to hell in a handbasket, and people will retweet that,” he offers some useful solutions.

An autocracy can deploy propaganda or use fear to motivate the behaviors it desires, but a democracy depends on widely internalized acceptance of the legitimacy of rules, norms, and institutions. Blind and irrevocable trust in any particular individual or organization is never warranted. But when citizens lose trust in elected leaders, health authorities, the courts, the police, universities, and the integrity of elections, then every decision becomes contested; every election becomes a life-and-death struggle to save the country from the other side.

Second, the dart guns of social media give more power and voice to the political extremes while reducing the power and voice of the moderate majority.

This is an interesting piece on why we don’t always need high-tech and complex solutions to make the world more sustainable. Plenty of low-tech solutions can significantly move the needle.

Charlie Warzel read my mind with this piece. The big news on the internet right now is Elon’s bid for Twitter. I find the news utterly pointless. Charlie is of the same view but adds that the reason why we have to pay attention to these “pseudo-events” is just in case Elon decides to follow through on his BS. More interestingly, he calls this whole episode GameStop for the rich.

The Dallas Fed in March published a note warning that the US housing market looks like a bubble 😲. Since it was written by economists, they hedged the proclamation by phrasing it as a question, but nonetheless, the insinuation was clear. Damn economists!

Our evidence points to abnormal U.S. housing market behavior for the first time since the boom of the early 2000s. Reasons for concern are clear in certain economic indicators—the price-to-rent ratio, in particular, and the price-to-income ratio—which show signs that 2021 house prices appear increasingly out of step with fundamentals.

But long, time housing market observers Bill McBride and Shawn Tully think there’s no bubble. Either way, this is something to keep an eye on. The last time US housing was hot, the global economy almost melted. It would be pretty funny if the US housing market were to lead to another financial crisis 😂

Inflation is behaving like a meme stock and continues to rise across the world. While some economists screaming about high inflation pre-pandemic have been vindicated and have become superstars, others are having to write “I was wrong” pieces. I don’t mean that in a pejorative sense, predicting things is hard, especially inflation. Anyway, here’s the first of many such pieces by Dylan Matthews at Vox and how he got his inflation is not an issue take wrong.

On the same note, I don’t get the calls for drastic rate hikes either. Here’s a brilliant thread by JW Mason explaining why:

Speaking of predicting things being hard, Jared Dillian had a nice piece on why the markets didn’t really bother for too long about the Russia-Ukraine war.

The market is smarter than you or I. In the beginning of the war, I was tweeting about how we were all going to get nuked into glass—and the VIX was below 30. It didn’t make sense. But the market discounting machine was working just fine. It knew before you or I did that the conflict was a stalemate and that Putin wasn’t a madman. Funny how that works.

A brilliant thread on Chinese vs European economic reforms.

Tyler Cowen predicts that thanks to the advancements like AI, most written communication will be done by bots.

I expect most written communication will eventually be done by bots. I could train my bot by letting it read all my previous email and other writings. Eventually my bot would answer most of my email directly, though it could hold some aside to ask me whether they merited a personal response.

This comment on the post was funny 😂 :

Extending this logic further, in future will we have only Blots instead of Blogs?

Papers

I know nothing about carbon taxes, carbon credits, and carbon markets. I’ve been wanting to learn about these things for a while. Coincidentally, I came across this paper titled Carbon Taxes and CO2 Emissions: Sweden as a Case Study by Julius Andersson this week. This paper was also one of the winners of the 2022 AEJ Best Paper Award. It’s a fascinating paper that shows that carbon taxes can significantly reduce emissions.

This paper shows empirically that a carbon tax can be successful in significantly reducing emissions of carbon dioxide. After implementation of a carbon tax and VAT on transport fuels in Sweden, CO2 emissions from transport declined almost 11 percent in an average year, with 6 percent from the carbon tax alone.

This paper reminded me of a couple of other papers and articles that add more colour and context to the topic of carbon taxes that I had saved. Thomas Douenne and Adrien Fabre published a paper called Yellow Vests, Pessimistic Beliefs, and Carbon Tax Aversion this year. They analyzed people’s perceptions towards a carbon tax during the Yellow Vests protests (gilets jaunes) in France that started in opposition to a green tax on fuel proposed by Emmanuel Macron.

The results were bleak. 70% of people opposed a carbon tax, even if the taxes were to be redistributed back to the people. 89% of the people overestimated the negative impact of a carbon tax on their purchasing power and didn’t think that a carbon tax makes an environmental difference. The most interesting part of the paper was that there was a strong case of confirmation bias among the people most opposed to the tax. They processed facts that supported their view and discarded those that showed the benefits of the tax. It goes to show that technocratic policymaking without considering how people form their beliefs is doomed to fail even if they are beneficial to the people. The Indian farm laws episode comes to mind.

Here’s a summary of the paper. Pair these papers with these articles by Tim Hartford and Tyler Cowen.

Podcasts and videos

This was a fascinating conversation about the US Civil War and the birth of the US dollar. I had no idea about this history.

This website with the history of US currency is also pretty cool.

Jonathan Haidt talking about his latest piece, which I linked above. It’s a nice compliment to the piece.

The end.

Leave a Reply