Here’s what I learned this week. One thing is that I’m going to be poor, but here are a few other things.

Charlie Munger famously said, “There are all kinds of tricks that I just got into by accident in life. One is to invert all the time.” Looks like the US bond yield curves took his advice.

Isn’t the greatest and the lamest opening to a blog post ever 😂

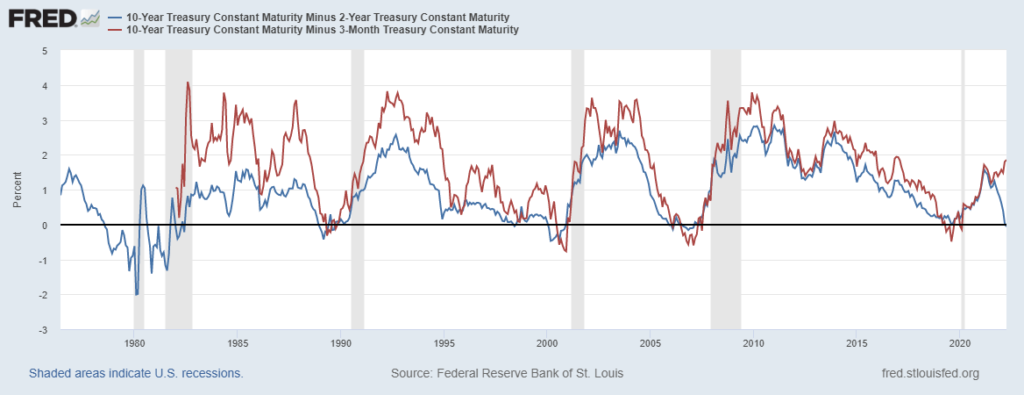

One of the biggest worries in the markets right now is the fact that some US bond yield curves are inverting.

Huh, what? You say?

In non-PhD terms, there are bonds of various maturities from 1-month to 30-year. A yield curve is a line graph that plots the yields of these bonds across maturities. Yield curves are typically upward sloping. The shorter maturity bonds have lower yields, and the longer maturity bonds have the highest yields because of the duration risk. So a 2-year bond will typically have a lesser yield compared to a 10-year bond.

But right now in the US, the yields on short-term Treasuries from 2-year to 7-year maturities are higher compared to the 10-year Treasury yield. This is weird and shouldn’t happen normally. Inversions are a sign that the economy is likely to slow down and maybe enter a recession. Yield curve watchers are worried that the curve is inverting so early into a rate hike cycle. Yield curves usually take time to invert once a rate hike cycle starts. But this time around, they are inverting when the Fed has hiked rates only once so far. “Experts” are predicting 5-7 more rate hikes.

The reason why people are freaking out is that inverted yield curves have predicted every recession since 1955. There’s a loud debate about causality. Do inverted yield curves signal a recession or cause recessions? Like a married couple, nobody agrees on anything.

So, a lot of people, including some Indian fund managers, have been screaming from their rooftops to their 73 followers on Twitter that a recession is coming.

Is a recession coming?

I had no clue. So I read some stuff about this. It turns out there are a lot of ifs and buts. The first question is, which yield curve? The popular 10-year minus 2-year curve has inverted. But a lot of people, including Cam Harvey, who did some pioneering research on yield curves, prefer to look at the 10-year minus the 3-month T-bill spread. This one has been going in the opposite direction, as you can see from the image above.

So, does an inverted curve predict recessions? As you can imagine, nobody agrees on anything in finance—they just bicker all the time. Some people think yield curves are omniscient, and some think they are overrated squiggly lines.

Here are some perspectives.

Jim Bianco thinks that the Fed doesn’t have any good options, just trade-offs. He says that inflation is the biggest issue in America right now since it disproportionately hurts the poor, and the Fed has no choice but to hike rates aggressively to tame inflation. In doing so, the Fed might go too far and cause a recession. His view is that the yield curves are signaling this reality.

Larry Swedroe wrote a post summarizing multiple research papers on yield curves in the US and other countries. The bottom line is that evidence for yield curves evidence is mixed. They predict recessions in some countries and don’t in others.

We find no evidence that yield curve inversions can help investors avoid poor stock returns.

Eugene Fama, Ken French

On a side note, Larry must have read more research papers than pretty much anybody on the planet. It’s crazy how many papers he’s summarized 0n TEBI, Alpha Architect, and Advisor Perspectives.

Eric Engstrom and Steven Sharpe of the Fed think that the evidence is “muddled” and “spurious.” Dare I say that they think this time is different? You could make a tiny case that two people from the Fed who think that yield curves don’t offer any insight are biased. But hey, what do I know!

Dare I say that they think this time is different? Here’s Johannes Borgen poking holes in these arguments.

Tom Graff on what the yield curves are saying and what they aren’t:

Cullen Roche says that the yield curve is a signal of a looming economic slowdown than a 100% recession indicator. His recent Twitter thread.

Joseph Politano published a post last week with a brilliant explanation of what an inverted yield curve tells and doesn’t. Hint: It doesn’t signal a 100% recession!

Alfonso Peccatiello (Alf) on which yield curves to watch.

In reading all this, my own view is that we are probably headed for a slowdown. But are we headed for a recession? I don’t really buy the yield curves predict 100% of all recessions arguments. More importantly, using yield curves to time the market or even use it to tilt toward some asset classes is akin to timing the market based on CAPE 1, 2, you’re gonna get your teeth knocked in.

Inversion in Russia

A different kind of inversion is playing out in Russia right now. Europe is importing more energy compared to the pre-invasion period.

Bloomberg estimates that Russia will make 30% more from energy exports compared to 2021. Even if you think Bloomberg’s projections are nonsense, other data points n the same direction. Russia is now making more from energy experts than ever. Of course, it’s almost completely shut out of the global financial system, so it can’t do much with that money. Things will also change dramatically if Europe completely shuts off Russian energy.

Oh, and Vox has a really nice collection of debates and perspectives on the various dimension of the economic fallout from the Russia-Ukraine crisis.

The environment inside Russia

A global famine?

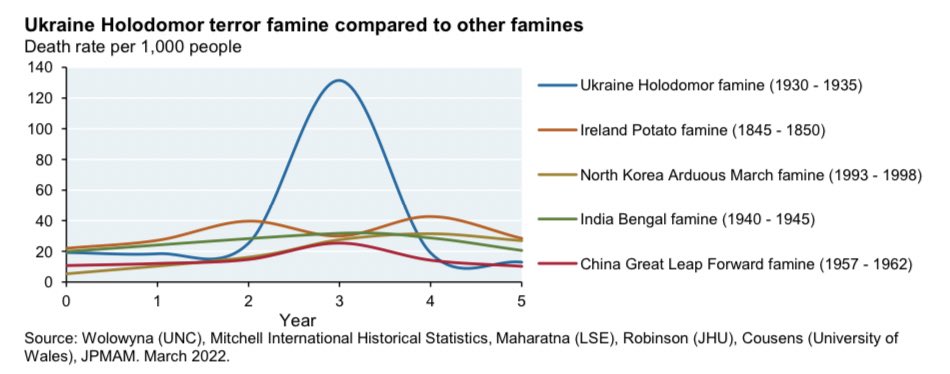

Michael Cembalest of JP Morgan had a really interesting note surveying the damage to the financial markets in the aftermath of the Russian invasion of Ukraine. This excerpt made me shudder:

Russia’s invasion of Ukraine is projected to result in one of the largest refugee crises in decades with 4-5 million people displaced1; long-lasting water, air and ground pollution in Ukraine; and 90% of Ukraine’s population facing poverty and extreme economic hardship if the war drags on to the end of 20222.For anyone surprised that Russia is imposing this brutal misery on Ukraine, don’t be: there’s ample precedent for it. As shown below, the Holodomor famine imposed by Russia on Ukraine in the 1930’s dwarfs other famines in terms of severity and is another example of Russian subjugation of Ukraine by any means necessary3.

I first learned about the brutality of Holodomor when I wrote this post a few weeks ago.

If the previous chart made me shudder, this one is giving me nightmares.

If you had asked me to take a bet on a global famine last year, I’d have sold my body parts and bet against it, but here we are. Fertilizer prices are spiking to historic highs, and there will be dramatic consequences on food supplies globally, from increasing grocery budgets to coups and revolutions.

From worrying about COVID-19 induced obesity in 2021 to a global famine in 2022, what a change. From the awesome Doomberg:

We believe we are at the onset of a global famine of historic proportions. In a staggering defiance of logic, many US politicians are still attacking the lifeblood of our own energy production infrastructure, looking to score political points against “the other team,” blaming price-taking producers of global commodities for gouging, threatening producers of energy with windfall profits taxes, resisting calls to remove bureaucratic hurdles to new production, and refusing to open an introductory physics textbook to help guide them through the suite of policy choices that require true leadership to get right. They remain stuck in an endless loop of platitudes, blamestorming, corruption, and ignorance.

But there are nuances to the scary headlines about food grain shortages:

Accidental nakedness

Did you know George de Mestral came up with the idea for Velcro after he saw some spiky seeds stuck to his dog? I didn’t. This is a fascinating story about the invention of Velcro. As with most inventions, Velcro had a difficult path to adoption, filled with accidental moments that would’ve made Casablanca blush:

There were hitches: Velcro’s CEO told Martha Hamilton at The Washington Post that the product wasn’t always as sticky as one would hope. “We had petticoats falling off of gals and brassieres popping open,” he said in 1983. And although De Mestral anticipated that his product would have widespread applications, including in the fashion industry, when Velcro finally made it to market it was a flop. Carmichael writes:

Smithsonian Magazine

Paper of the week

In 2013, the legendary late David Graeber wrote what is, in my view, one of the most important articles in the history of humanity. The piece was titled “On the Phenomenon of Bullshit Jobs: A Work Rant.” In it, he wrote that instead of using technology to figure out ways to work less, we’ve used it to create a corporate hellhole with pointless jobs like human resources and public relations. Of course, there are a lot of critiques about the theory 1, 2, but from my limited experience, it’s spot on.

Here’s how he described BS jobs in an interview:

Sean Illing: Give me some examples of bullshit jobs.

David Graeber: Corporate lawyers. Most corporate lawyers secretly believe that if there were no longer any corporate lawyers, the world would probably be a better place. The same is true of public relations consultants, telemarketers, brand managers, and countless administrative specialists who are paid to sit around, answer phones, and pretend to be useful.A lot of bullshit jobs are just manufactured middle-management positions with no real utility in the world, but they exist anyway in order to justify the careers of the people performing them. But if they went away tomorrow, it would make no difference at all.

And that’s how you know a job is bullshit: If we suddenly eliminated teachers or garbage collectors or construction workers or law enforcement or whatever, it would really matter. We’d notice the absence. But if bullshit jobs go away, we’re no worse off.

If there were an educational equivalent of bullshit jobs, it would have to be an MBA degree—hands down, no contest at all. Humanities also, maybe? 😬😂 Oh, and I did an MBA, so I am an authority on the subject; I have skin in the game.

It’s not just that MBAs are pointless; they are a net negative to society. Here’s a brilliant paper from Daron Acemoglu, Alex He, and Daniel le Maire:

Wage growth has slowed down and the labor share in national income has declined in many advanced economies over the last three decades. We argue that a contributing factor has been changes in wage policies of firms associated with business education of their managers/CEOs. We explore the effect of business managers on wages and the labor share using matched employer-employee datasets from the US and Denmark. In both countries, business managers reduce the wages of their employees. For example, five years after the appointment of a business manager, wages decline by 6% and the labor share by 5 percentage points in the US, and 3% and 3 percentage points in Denmark (relative to firms operated by non-business managers).

In line with this last set of estimates, we interpret our results as reflecting the business-schoolled shift towards emphasizing shareholder values (following Milton Friedman, 1970) and attempts to reengineer corporations by making them leaner (Hammer and Champy, 1993). Unfortunately, in the current paper, this is no more than an interpretation, since we do not have any direct evidence on the micro channels through which business education changes managers’ overall approach and wage policies.

If tomorrow we got rid of 99% of the MBAs, the world would be a much better and more peaceful place. What I’m saying might sound juvenile, but it honestly is a pointless degree. We’ve mass-produced millions of MBAs around the world like washing machines, but 99.9% of them are utterly useless. To some extent, I get the point of doing an MBA from a top college like IIM, Harvard, and Stanford, they at least have some signaling value. But getting an MBA from lesser-known colleges is as good as doing your undergraduate degree twice. It’s no wonder that 93% of Indian MBA grads are unemployable.

It’s not just that they are useless, most of what’s taught in MBAs is loosely based on neoliberal or free-market ideology—the markets are all-seeing, all-knowing, and self-correcting. Not that this is wrong, but the problem is the lack of nuance. It goes without saying that whether free markets are an unalloyed good to bad or somewhere in the middle is a contentious debate. We’ve been arguing for nearly a century. Some, like David Graeber think that neoliberalism is less an ideology and a more political project, and then you have the others who worship Hayek and Friedman.

The neoliberal (“free market”) ideology that had dominated the world since the days of Thatcher and Reagan was really the opposite of what it claimed to be;it was really a political project dressed up as an economic one.

Bullshit Jobs: A Theory

But what is clear is that this ideology has caused a lot of damage. It had directly contributed to rising inequality, market concentration, declining antitrust, a falling share of labor, and increasing fragility. Of course, it’s not all bad. On the other side, we have increased choices, cheaper goods, and a better quality of life. But you rarely see this nuanced version being taught. The textbooks and the professors say that free markets are perfect.

The important question to ask is how did these neoliberal ideas infiltrate education? James Kwak tracks the history brilliantly in his book Economism. After the great depression of the 1930s, Franklin Roosevelt (FDR) and the Democrats came to power in the US. FDR, with the New Deal, dramatically expanded the role of the government with social security, unemployment benefits, union-friendly policies, and stringent financial regulations. World War 2, further entrenched the centrality of the government in the economy, and big businesses had no choice but to go along.

But by the 1960s, big business was sick of tired of big government, unions, and high taxes. They wanted to dismantle the system, and they co-opted the ideas of free markets and small government espoused by Hayek and Friedman. Large businesses and influential people like General Electric, General Motors, Chrysler, the Koch’s and other sympathetic organizations started spending heavily to push these ideas through think tanks, books, newspaper columns, schools, and colleges. They had an army of ideologies spreading the message of the free markets across America. These organizations and people figured that the educational system was the best way to spread these ideas. They went to the extent of endowing college chairs with people sympathetic to their ideas. Over a period of time, the free market ideology, or Econ 101 as James Kwak calls it seeped all the way from schools to supreme court judges.

Today, most of what’s taught in MBAs and, by extension, practised by management consultants is a brilliant repackaging of neoliberal rent-seeking ideas, going back to the point that Acemoglu et al. make in the conclusion of the paper. MBAs are taught to prize efficiency above all else without considering the side effects. This line of thinking is incredibly good for companies but bad for workers. This is the same nonsense peddled by consulting companies like EY, Deloitte, and McKinsey. For this generous contribution to humanity, they make billions in revenues—they did find those synergies.

But coming back to David Graeber’s line of thinking, you have to admire the ingenuity of the MBAs. They’ve created entirely new industries, like management consulting, which are beyond pointless. The fact that these MBAs get paid for showing people PPTs with BS terms like “synergy,” “cross-pollinate,” “bleeding edge,” and “think outside the box” to say absolutely nothing is genius. It’s not just my idle rant, the consultants themselves confess to it 1, 2 .

As the joke goes:

What difference does the MBA do a student?

A: It teaches him about strategy, finance, ROI and ensures that he understands these by putting him in about 100,000$ in debt.

What poor people say

I don’t yet have a particular view on crypto since I don’t really understand it properly. I’d assume that the odds of me ending up poor are quite high.

A few perspectives by crypto skeptics that I came across this week.

Apart from the scams, grifts, hacks, and the fact that it’s useless, Molly White thinks that Web3 is going really great. How great? Listen 👇

Leave a Reply