Niall Ferguson is one of the smartest and the most provocative financial historians of our time. His controversial reading of history has earned him a reputation as an enfant terrible among historians. He’s also a prolific author with 16 books on subjects ranging from the history of money, Rothschilds, war, Kissinger, and pandemics.

His name most often comes up in the context of cancel culture, wokism and is often labeled as a conservative. But this whole notion of assigning labels not only doesn’t do justice to the man’s intellect, but is also stupid. As he often says, people with “anti-liberal” views are labelled as conservatives.

I didn’t know a whole lot about him. Whatever I knew was mostly from the articles and reviews of his books.

Last year he had appeared on the Lex Fridman Podcast, and I heard the episode last week—it was absolutely fascinating. A few minutes into the conversation on money and it immediately became clear why he’s considered one of the best historians of our time. His vast grasp of economic and financial history and his ability to marshal it in defense of his contrarian and revisionist arguments is impressive, to say the least.

The first part of the conversation is about the controversial University of Austin. It’s a new university by a bunch of controversial, “conservative,” and “anti-woke” figureheads like Bari Weiss, Steven Pinker (he quit), Heather Heying, and Joe Lonsdale among others. They want to offer courses that are either banned or aren’t offered by the “liberal” education system.

He talks about the rampant censorship, wokeness, and stifling of free speech at universities. He makes a passionate case for old-school university values, academic freedom, and not having to live in constant fear of saying the wrong thing and getting cancelled. Enter The University of Austin—a safe space for people who want anti-cancel culture, and anti-woke perspectives.

I wasn’t too interested in this part of the conversation because I haven’t kept close track of the rising wokeness, cancel culture, and the culture wars. I don’t really look forward to taking a dip in those putrid waters.

What I was interested in were his perspectives on crypto, money, and DeFi. Crypto at this point is like living right next to relatives you absolutely despise. You have to grit your teeth and still smile at them every morning. So, I’ve been trying to learn about crypto in the hopes that I don’t become a victim of poverty.

Cryptocurrencies might just be a decade old, but history is littered with private and alternative currencies. Having a historical perspective is quite useful in understanding this moment when many people want to tear down the fiat money system and replace it with dog coins, ass coins, and cat coins.

The Chinese guys are real pricks. They’ve been messing with us throughout history. It’s not just them eating bats, causing a global pandemic, and almost wiping humanity sci-fi movie style. Remember that old guy who cast the “may you live in interesting times” curse? What an asshole!

There were a lot of interesting takeaways from the podcast, so I made some notes. I’ve added snippets from the conversation transcript and related links in italics.

On money

The origins of money can be traced back 5000 years to ancient Mesopotamia. Clay tablets were used to record transactions between debtors and creditors.

You can check out images of these Cuneiform tablets on The Metropolitan Museum’s website.

Trust is what makes money work. Anything can be money as long as it can be used to record a relationship between a debtor and a creditor. Ultimately, money is a manifestation of trust. Money crystallizes the relationship between debtors and creditors.

The whole thing depends on our collective trust to work. I had to explain this to Stephen Colbert when he said “um, so Neil could I be money?” and I said, yes. You know we could settle a debt with a human being that was quite common in much of history, but it’s not the most convenient form of money, it has to be convenient.

The shortage of coinage after the Black Death in the 1300s led to the birth of bills of exchange. They were the first peer-to-peer network-based payments system that wasn’t based on money, as defined as coins and notes—they were just IOUs. Bills of exchange were DeFi (Decentralized finance) before DeFi, and they supercharged global trade.

One of the highlights of the conversation was about monetary stability. He made a fascinating point about how the current stability of the global monetary—barring the occasional crises, of course, system—is an aberration. It’s an interesting notion, given that we’re living through a moment in history where we’ve probably never seen monetary policy experiments on such a scale.

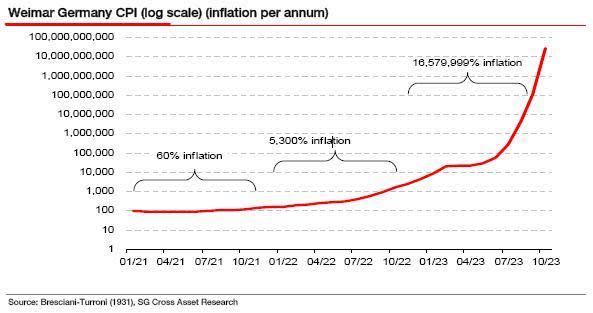

If you take a sweeping look over hundreds of years, history is littered with failed monetary systems and currencies. Over the past 500 years, multiple currencies and coinage systems have been decimated because of wars and inflation. Several currencies in Europe, including the Russian, German, Polish, Serbian and Austrian failed in the 1900s during World War 1.

On a related note, Ray Dalio made a similar point in a recent post about how most currencies throughout history have failed:

Of the roughly 750 currencies that have existed since 1700, only about 20 percent remain, and all of them have been devalued. If you went back to 1850, as an example, the world’s major currencies wouldn’t look anything like the ones today. While the dollar, pound, and Swiss franc existed in 1850, the most important currencies of that era have died. In what is now Germany, you would have used the gulden or the thaler. There was no yen, so in Japan you might have used the koban or the ryo instead. In Italy you would have used one or more of six currencies. You would have used different currencies in Spain, China, and most other countries as well. Some were completely wiped out (in most cases they were in countries that had hyperinflation and/or lost wars and had large war debts) and replaced by entirely new currencies. Some were merged into currencies that replaced them (e.g., the individual European currencies were merged into the euro). And some remain in existence but were devalued, like the British pound and the US dollar.

The other fascinating point he makes is that financial innovation is the result of a series of rolling crises.

We had to invent the bond market in the 18th century to cope with the problem of public debt which up until that point had been a recurrent source of instability, and then we invented equity finance because bonds were not enough, so I would prefer to think of the financial history as a series of crises really that are resolved by innovations and in the most recent episode very exciting episode of financial history something called Bitcoin.

On Crypto

Satoshi didn’t create Bitcoin over fears of a breakdown of the fiat-based financial system. Bitcoin was a response to the need for internet native money.

The crypto financial revolution is way past that point where it can be killed. It has sufficient adoption and momentum behind it to survive existential threats like the Chinese mining ban.

It’s tough to figure out the damage that regulators will cause with crypto regulation. They might not be able to kill crypto, but they can kneecap it with regressive regulations.

Central Bank Digital Currency (CBDC) is a dangerous idea that makes Chinese-style surveillance possible. CBDCs are a way for vested interests to stop the march of crypto.

Bitcoin won’t replace fiat currencies. Bitcoin is an option on digital gold.

No, I think what bitcoin is this was a phrase that I got from my friend Matt McLennan (First Eagle) is an option on digital gold. So it’s the gold of the system, but currently, it behaves like an option that’s why it’s quite volatile because we don’t really know if this brave new world of crypto is gonna work but if it does work then bitcoin is the gold because of the finite supply.

Holding some crypto given the post-pandemic debt binge, the low bond yields and a looming tech bubble isn’t a bad idea.

The IRS won’t care about crypto as long as you pay taxes.

Crypto is a portable store of wealth, especially in failed and dangerous countries like Venezuela and Zimbabwe.

Being 100% in crypto if there’s a World War 3 is a terrible idea because it will also be a cyberwar. Diversification is always a good idea.

Smart contracts can eliminate a lot of simple and some seemingly complex financial transactions like mortgages and insurance. The reason mortgages and insurance have 1000s of pages of terms and conditions is because of regulatory “ass covering.”

Small and poor households are at the mercy of big banks. Crypto and other fintech solutions can be a solution.

A lot of financial transactions have the potential at least to be simplified automated, turned into smart contracts that that’s probably where the future goes. I can’t see an obvious reason why my range of different financial needs, let’s think about insurance, for example, will continue to be met with instruments that in some ways are 100 years old. So I think we’re still in an early stage of a financial revolution that will greatly streamline how we take care of all those financial needs that we have uh mortgages and insurance leave leap to mind you know most households are penalized for being financially poorly educated and confronted with oligopolistic financial services providers.

Money remittance is punitively costly, and tech can solve that.

The financial system that the west builds can’t be similar to China, that’s based on surveillance and data plundering. Modelling payments, and CBDCs on the Chinese model is a terrible idea.

Those were some of the highlights about money from the conversation. The rest of the conversation is about history, pandemics, politics, and philosophy.

One reason why he evokes such strong reactions among people is because of his counterfactual treatment of history—looking at history from a what if lens. One counterfactual he talks about in this conversation is that if Britain had stayed out of World War 1 and Germany had won, it would’ve just been a European war and Hitler would’ve just been a failed artist. You need some heavy brass balls to make that argument.

Similarly, his other controversial counterfactual, which isn’t in this conversation, is that the British Empire was actually a force for good. Just thinking about the fact makes me squirm, but he’s written a book on it. Here’s his explanation from his conversation with Tyler Cowen:

Well, my heretical position — and it’s been my view for at least 20 years — is that the benefits of the British Empire outweighed the costs. If one does a cost-benefit analysis of British imperialism, one comes to the conclusion — if one is in any way rigorous about it — that it was a remarkably benign empire compared with other available empires.

And the counterfactual is crucial here because those people on the left who make a living out of comparing the empire to the Third Reich are just not being rigorous. They’re committing category errors, and more importantly, they’re not positing realistic counterfactuals.

Assorted stuff

After listening to the podcast, I was smitten by the man 😂

I’ve added The Ascent of Money, Doom, and The House of Rothschild (Part 1, Part 2) to my Marathahalli traffic jam long book wish list. These are fascinating rabbit holes to go down.

Here are some related things I read.

After Crypto’s Cold Winter, Expect Springtime for Web 3.0

50 Years After Going Off Gold, the Dollar Must Go for Crypto

Leave a Reply