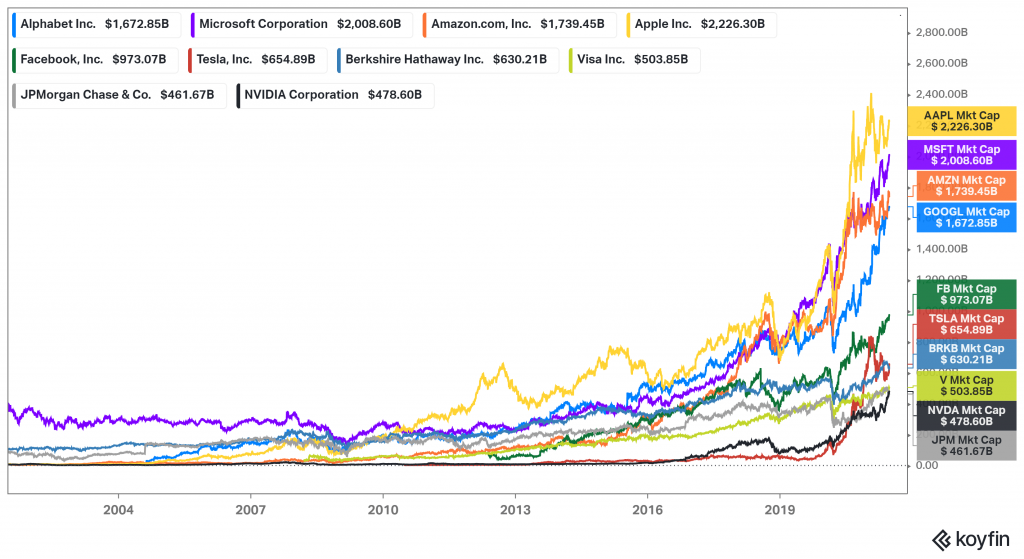

Microsoft hit $2 trillion in marketcap a few days ago. There was a time when a trillion meant something, but it doesn’t seem so anymore. Microsoft and Apple now are worth over $2 trillion. It’s a silly comparison, but for context, the market cap of all listed companies on NSE is a little over $3 trillion.

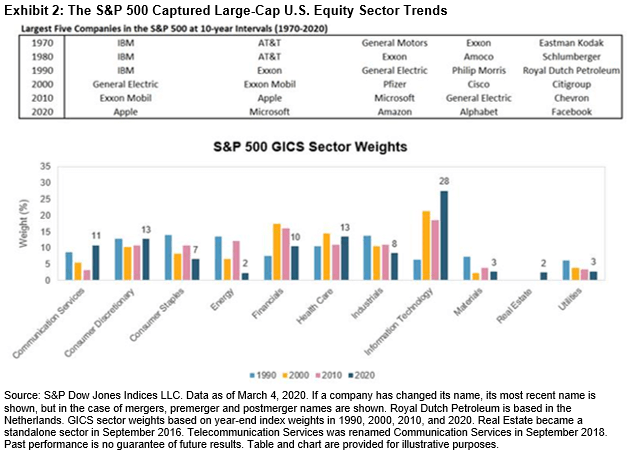

The growth of big tech companies has been phenomenal. Here’s a look at the historical sector composition of the S&P 500. The way they’ve replaced the old economy and staid old names is remarkable.

Not just the indices, these big tech companies now dominate our lives. From the phones we use to the entertainment we consume, the big tech companies, particularly the FANMAG companies (Facebook, Amazon, Netflix, Microsoft, Apple, and Google are dominant.

This dominance of big tech companies has raised a lot of concerns worldwide. On the one hand, people want tighter regulation of these companies, and on the other hand, there people calling for an outright breaking up of these companies.

Heading in the next decade, this regulation of these big tech companies will be front and centre. We’re already seeing the first wave of regulations, from the billion-dollar fines and the continued investigations in the European Union to the latest big tech reform and antitrust bills in the United States.

But regulating these big companies and platforms isn’t as easy as just breaking them up. The debate about regulating technology companies and platforms has become about scoring political points and posturing. Nuance has been a casualty in these discussions.

There are no black and white solutions. These companies and platforms are neither 100% evil nor 100% innocent. For example, in April 2012, leaked documents showed that Google used data from this ad exchanges to give its own ad buying an upper hand over competitors. The EU has fined Google billions for abusing its dominance and stifling competition. But millions of people worldwide benefit from Google’s free services like Gmail, Maps, YouTube, etc. The same goes for most tech companies and platforms.

Most regulatory proposals are simple solutions for complicated problems based on rules and understanding from a bygone era.

There will be real-life consequences to any regulatory actions and some nasty trade-offs. But regulations are coming, and that’s for sure. And these regulations will have a real-life impact on you and me. Be it on the products we use or the tech-focused funds we invest in our portfolios.

However you slice it, big tech regulation is one of the defining issues of our times. Watching how regulators and governments tackle the issue will be fascinating to watch.

Further reading

Leave a Reply